💰 Money & Wealth Mindset: Build Rich Habits, Not Just Income

Money is not magic. Wealth is not luck. Real wealth is built through mindset, discipline, and long‑term thinking. If you master how money works, money will start working for you.

🔥 The Truth About Wealth

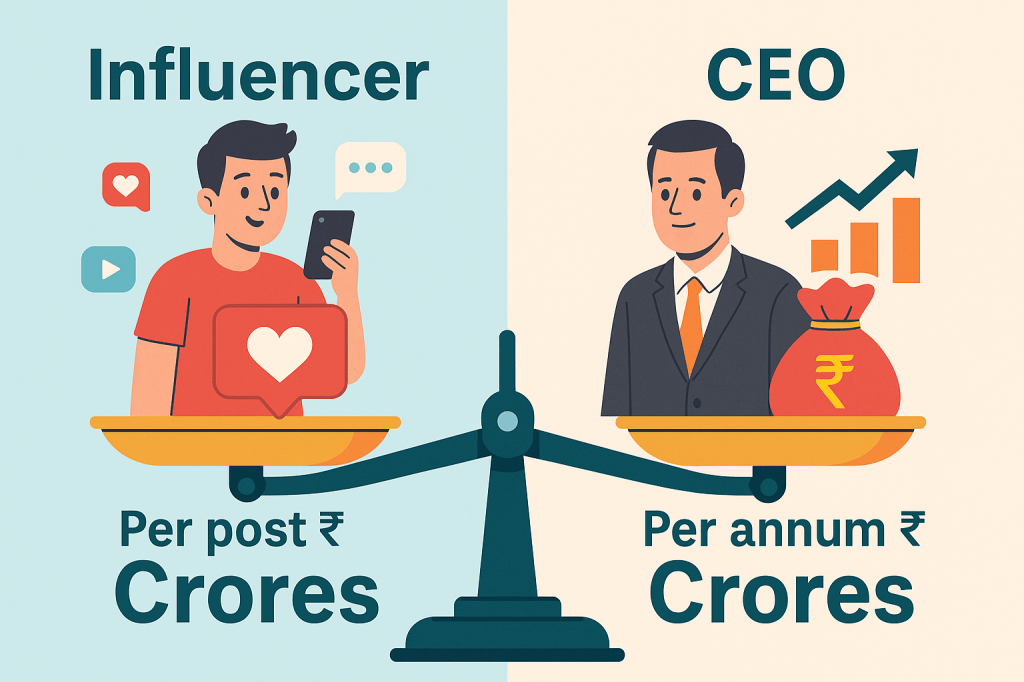

- Wealth is created, not chased

- High income without discipline still leads to poverty

- Small daily habits decide your financial future

🧠 Billionaire Mindset Shift

Rich people ask: “How can this money grow?”

Poor thinking asks: “How can I spend this?”

- Build assets before lifestyle

- Invest before expenses

- Think years ahead, not weekends

🌱 Spiritual Side of Wealth

When gratitude meets discipline, abundance follows. Wealth flows to those who respect money, not fear it.

“I respect money. I invest wisely. I attract opportunities that multiply my income.”

🚀 Simple Habits That Create Wealth

- Track every rupee or dirham

- Invest monthly, even small amounts

- Avoid unnecessary debt

- Upgrade skills, not just gadgets

📌 Final Thought

Wealth is not about getting rich fast.

It’s about building freedom forever.